Overview

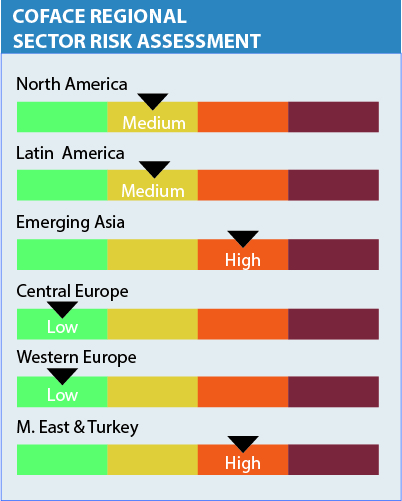

Summarising the current automotive market is difficult because trends vary so widely between different territories. Sales are booming in Europe generally, but slowing in the UK, USA and China. The picture is further complicated by changing technologies and increasing pressures to meet environmental standards. There are also nation-specific factors, such as the uncertainties surrounding Brexit in the UK and taxation changes in China aimed at reducing pollution.

Strengths and weaknesses

The automotive sector’s main strength is its focus on R&D and innovation, which is enabling it to cope with the demand for ‘cleaner’ engines and alternatives technologies such as hybrid and electric cars. Sales in China are expected to fluctuate, but Coface economists forecast a 4-5% increase in 2018, driven by the changeover to electric and hybrid vehicles. This is being encouraged by the government through taxation changes. However, the market in the USA is unlikely to recover, with borrowing costs high. Even in Europe, demand is forecast to peak in 2018, then slow down gradually.

With such a patchy picture this is an industry in which it’s essential to protect your business from cashflow problems and payment defaults – not only with credit insurance from Coface, but also with an unrivalled fund of market intelligence.

Related resources

One unpaid bill?

Who gets paid first when a company goes bust? When a company goes into administration or liquidation, its remaining assets are sold to clear as many of its obligations as possible.

25 March, 2021

Trade Credit Insurance Explained – with working examples

Credit insurance protects you against bad debt. So if the worse happens, you still get paid.

18 March, 2021

The paradox of corporate insolvencies in Europe: miracle and mirage

The economic crisis caused by the COVID-19 pandemic heralded major business failures and insolvencies in France, and across the eurozone as a whole.. But, in 2020, and even if the real impact of the COVID-19 crisis remains

17 March, 2021