Overview

Spending on prescription drugs is on an upward trajectory worldwide, and especially in Western Europe and the US. Pharma group profits rose by 2.9% in 2017. Reasons include ageing populations, changing lifestyles and pressure to access innovative treatments, and the rise comes despite the efforts of governments to control healthcare spending. The US situation is particularly uncertain, with the Trump administration’s attempts to repeal ‘Obamacare’ meeting difficulties.

Strengths and weaknesses

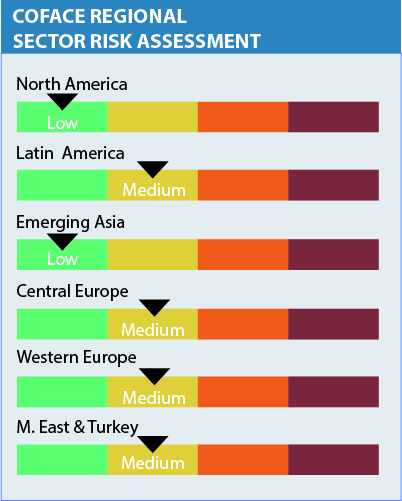

Coface analysts predict research and development by pharmaceutical companies to pick up in 2018, and for prescription sales to grow – by 4% France, UK, Germany, Italy and Spain for example. This is driven by the rise in specialist drugs, which now amount to over a third of the total. Everywhere pharmaceutical companies are under pressure to provide discounts and lower prices by governments facing increasing demand. In the US alone, health insurance costs are likely to rise by as much as 18% in 2018.

Throughout the world healthcare provision is in flux and prices are being driven down. That’s why any company dealing with the pharma sector needs to have the best business data and insight on tap. It all comes free when you’re a Coface credit insurance policy holder.

Related resources

One unpaid bill?

Who gets paid first when a company goes bust? When a company goes into administration or liquidation, its remaining assets are sold to clear as many of its obligations as possible.

25 March, 2021

Trade Credit Insurance Explained – with working examples

Credit insurance protects you against bad debt. So if the worse happens, you still get paid.

18 March, 2021

The paradox of corporate insolvencies in Europe: miracle and mirage

The economic crisis caused by the COVID-19 pandemic heralded major business failures and insolvencies in France, and across the eurozone as a whole.. But, in 2020, and even if the real impact of the COVID-19 crisis remains

17 March, 2021