The recent trend has been for a sustained drop in prices being paid for transport around the world. But strong demand for air transport, which grew by 4% in 2017, is the big story in global transport. It’s a symptom of the general economic recovery, and in particular of the rise of the middle class in Asia, along with falling ticket prices (they have halved over the past 20 years in real terms).

Contrast this with the roads sector, which varies wildly from region to region, and the cargo sector where overcapacity is the current problem.

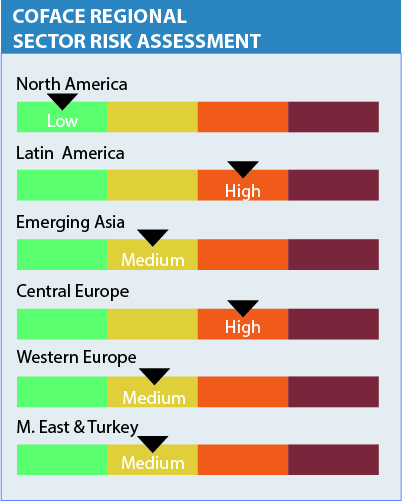

Coface projects continuing growth in demand for transport in 2018, with the rail, road and maritime sectors thriving. Western European road transport is benefiting from historically low fuel costs. However, Latin America will continue to be hit by the underdeveloped infrastructure, increasing freight costs and putting a brake on demand.

The simple truth about the transport industry is that it very susceptible to external factors, from oil prices to weather and economic conditions. Coface credit insurance, and our constant flow of industry intelligence add up to essential protection for your business.

Related resources

One unpaid bill?

Who gets paid first when a company goes bust? When a company goes into administration or liquidation, its remaining assets are sold to clear as many of its obligations as possible.

25 March, 2021

Trade Credit Insurance Explained – with working examples

Credit insurance protects you against bad debt. So if the worse happens, you still get paid.

18 March, 2021

The paradox of corporate insolvencies in Europe: miracle and mirage

The economic crisis caused by the COVID-19 pandemic heralded major business failures and insolvencies in France, and across the eurozone as a whole.. But, in 2020, and even if the real impact of the COVID-19 crisis remains

17 March, 2021